While taking money early from a workplace retirement plan is generally a no-no, victims of Hurricane Harvey now have that option.

The Internal Revenue Service announced Wednesday that 401(k) plans and similar plans may permit participants to take loans against their accounts or make hardship withdrawals if they or family members have been affected by the flooding and destruction from Hurricane Harvey.

This means that even if you live outside the disaster area, you can tap your own 401(k) plan to assist a family member in the affected areas. The normal 10 percent early withdrawal penalty for those under age 59½ (with a few exceptions) will still apply and you'll owe income taxes on the money as well.

And typically, hardship distributions also come with a six-month ban on new contributions. The IRS is waiving that. To qualify for relief, the agency says distributions must be made between Aug. 23, 2017, and Jan. 31, 2018.

Loans generally come with no tax implications if they are repaid within five years. However, as with early withdrawals, loans remove money from investments intended to grow and provide income to you in retirement.

Just make sure you don't have better options before taking money from your 401(k). It's not free money.Mark McClanahanmanaging director, RGT Wealth Advisors

The IRS also said it is relaxing certain administrative rules to let people access their 401(k) funds "with a minimum of red tape."

Tapping that 401(k) plan money can come at a cost, however. Certified Financial Planner Mark McClanahan said that although taking money early from your retirement account is far from ideal, some Harvey victims will find themselves relying on it.

"There are people who are going to have dramatic expenses related to this storm," said McClanahan, a managing director at Dallas-based RGT Wealth Advisors. "Just make sure you don't have better options before taking money from your 401(k). It's not free money."

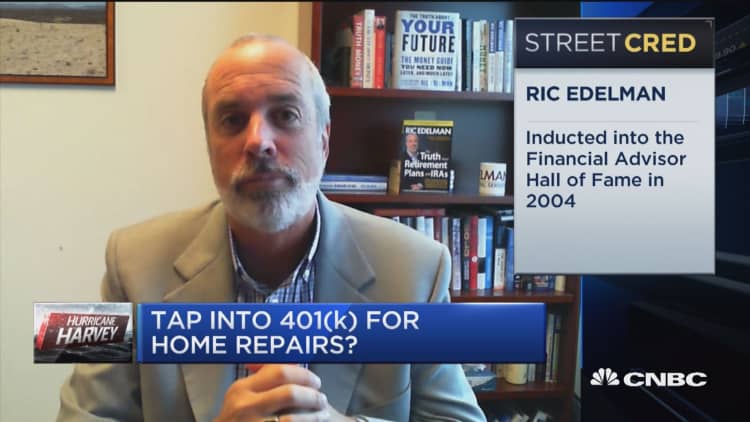

WATCH: Big concern is people who don't have flood insurance